Are you feeling overwhelmed by your finances? Do you want to take control of your money without diving into complex budgeting methods?

Here’s a simple method: The 50/30/20 budgeting model is here to make managing your money easy and effective!

One of the major advantages of the 50/30/20 model is its simplicity. You don’t need a background in finance to get started. It’s a user-friendly budgeting tool that puts you in control.

Understanding the 50/30/20 Budgeting Model

What is the 50/30/20 Budgeting Model?

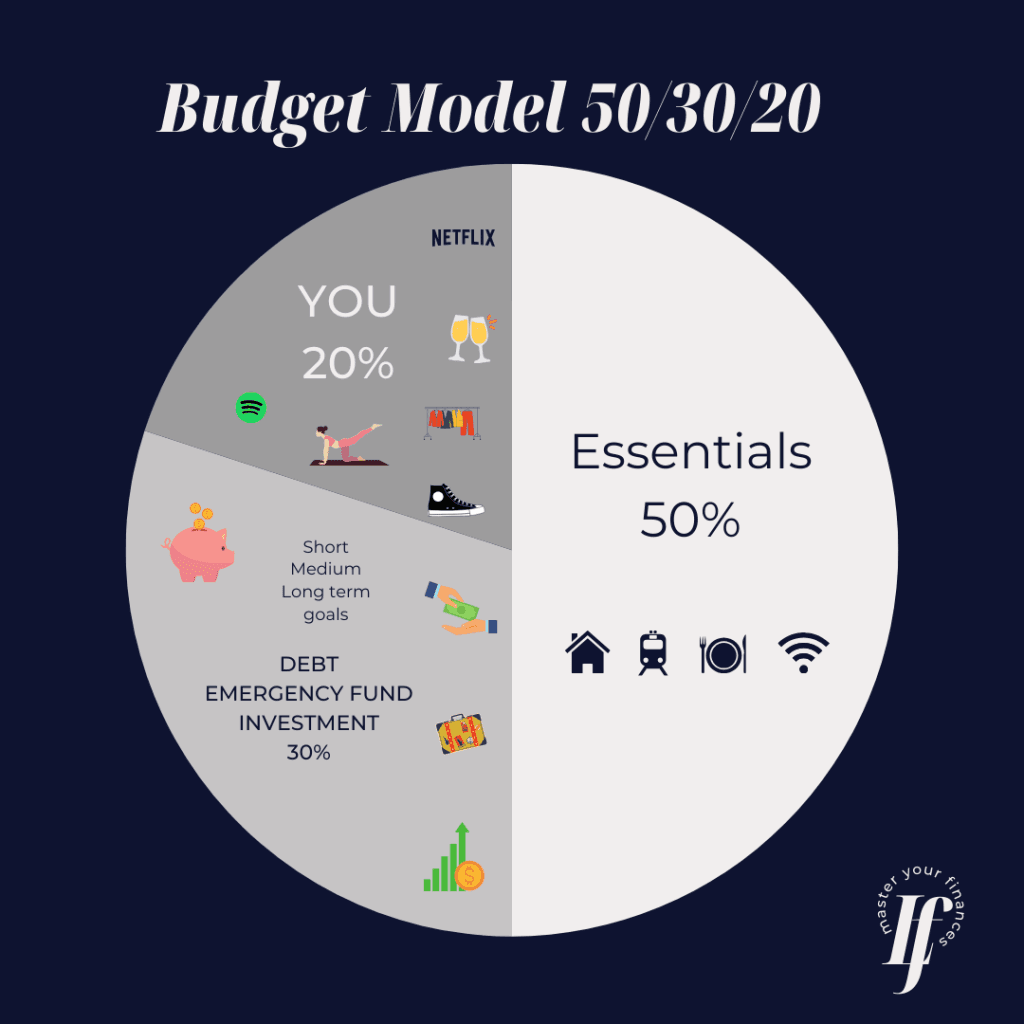

The 50/30/20 budgeting model is a straightforward and flexible approach to managing your finances. It helps you divide your income into three categories:

- 50% for Needs: This includes essential expenses like rent, utilities, groceries, and transportation.

- 30% for Future: Tackle any outstanding debts and start saving for your future with this portion of your income.

- 20% for Present/Wants: This category covers non-essential expenses such as dining out, entertainment, and personal hobbies.

How to Implement the 50/30/20 Model

Step 1: Calculate Your Monthly Income

Determine your monthly take-home pay. This is the amount you receive after taxes and other deductions. If you work for yourself, calculate the average salary of your last 6 months.

Step 2: Allocate 50% to Needs

Identify your essential expenses, such as rent or mortgage, utilities, groceries, and transportation. Allocate 50% of your income to cover these necessities.

Step 3: Allocate 30% to Debt Repayment, Savings, and Investments

Build a secure future by putting 30% of your income towards paying off debts, savings and investments. Set up an emergency fund of 3-6 months of your essentials (needs), contribute to a pension plan and learn to invest to build on your pension funds.

Step 4: Allocate 20% to Wants

Enjoy life a little! Allocate 20% of your income to non-essential expenses like dining out, entertainment, and personal luxuries.

Tips for Success

- Track your spending: Keep an eye on where your money goes. Apps and budgeting tools can make this process painless.

- Adjust as needed: Life changes, and so might your financial situation. Feel free to adjust your allocations when necessary.

- Celebrate milestones: As you reach your financial goals, celebrate your achievements – whether it’s paying off a credit card or reaching a savings target.

- If you can’t fit into the model perfectly, try to adjust it to your current reality until you can follow it. What matters the most is that you are actively managing your money, not being managed by it.

- The original 50/30/20 method suggests you should allocate 30% to lifestyle, but I am suggesting you reduce it to 20% until you have a healthy amount of money saved.

Get Started Today!

The 50/30/20 budgeting model is a fantastic tool for individuals looking to take control of their finances. Start your journey to financial wellness today by implementing this simple and effective budgeting strategy.

Remember, your financial freedom is just a budget away!

If you need support getting started, click here and buy your copy of the Master Money Plan today!

———

About Master Your Finances

Master Your Finances helps to make money matters simple for everyone. This mission is guided by the principle that you are the best person to make decisions about your own personal finances.

Built on three central pillars of self-responsibility, simplicity and independence, Master Your Finances focuses on empowering people to save, manage and grow their money in the UK.

Through founder and managing director Leticia Fonseca, Master Your Finances has helped thousands of individuals master their finances through guidance on how to:

- Get out of debt

- Organise their finances and start budgeting

- Invest in the UK

- Boost their retirement savings

Master Your Finances offers services and structures to suit a variety of needs:

- Personalised one-to-one financial wellbeing sessions

- On-demand money management courses

- Group workshops

- Group mentoring programmes to start investing in the stock market

- Financial well-being awareness seminars

Find more information at masteryourfinances.co.uk