The rising cost of living leaves many of us struggling to keep up. Deloitte research says consumer confidence is at its highest since Q4 2021 – but is that confidence misplaced? We know personal debt is increasing. People are increasingly relying on credit cards, finding it challenging to manage their payments.

With the Black Friday sales upon us, let’s ask a crucial question: What are you choosing not to buy this Black Friday?

As responsible adults, we often have the means to purchase what we need, even if it means buying in instalments. But the truth is, you probably don’t need anything right now.

Instead of following the adverts into deeper debt, how about trying out these alternative exercises:

- Declutter your life: Get rid of things you no longer use. Make space in your life, cupboards, drawers and wardrobe. Give yourself some quiet.

- Question your purchases: If you’re contemplating a purchase, ask yourself:

- Do I have enough money for this?

- What will I do with it?

- How often will I use it?

- Do I genuinely want this?

- If you still want to proceed, consider:

- Could I borrow it or buy it secondhand for less?

Engage in a mental game. If you decide against a purchase after answering these questions, redirect the money toward making more money.

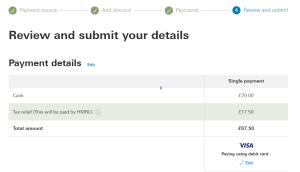

For example: I planned to buy new black shoes, anticipating a need for formal occasions. Realising I wouldn’t use them often because I rarely wear high heels, I instead diverted the money to top up my Private Personal Pension. The government added 25%, turning £70 into £87.50. Although inaccessible until I’m at least 57, this money will grow over a decade. (see proof what what I mean below)

This financial strategy isn’t about locking up your money; it’s about using it wisely – whether in ISAs, personal development, or investments that generate returns.

For some inspiration, there’s the chance to participate in Buy Nothing Day this Friday – a 24 hour detox from purchasing and an opportunity for you to tune into your personal financial situation and direction.

As part of this journey towards smarter financial decisions, stay tuned for my upcoming project: the Master Money Plan. It’s a simple course designed to empower you to make informed financial decisions and make your money work for you.

——–

About Master Your Finances

Master Your Finances helps to make money matters simple for everyone. This mission is guided by the principle that you are the best person to make decisions about your own personal finances.

Built on three central pillars of self-responsibility, simplicity and independence, Master Your Finances focuses on empowering people to save, manage and grow their money in the UK.

Through founder and managing director Leticia Fonseca, Master Your Finances has helped thousands of individuals master their finances through guidance on how to:

- Get out of debt

- Organise their finances and start budgeting

- Invest in the UK

- Boost their retirement savings

Master Your Finances offers services and structures to suit a variety of needs:

- Personalised one-to-one financial wellbeing sessions

- On-demand money management courses

- Group workshops

- Group mentoring programmes to start investing in the stock market

- Financial well-being awareness seminars

Find more information at masteryourfinances.co.uk